BTC Price Prediction: 2025-2040 Outlook Amid Institutional Adoption and Monetary Shifts

#BTC

- Technical indicators show BTC trading above key moving averages with bullish momentum

- Federal Reserve rate cuts and institutional adoption creating favorable macro environment

- Long-term price predictions reflect increasing scarcity and mainstream adoption potential

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

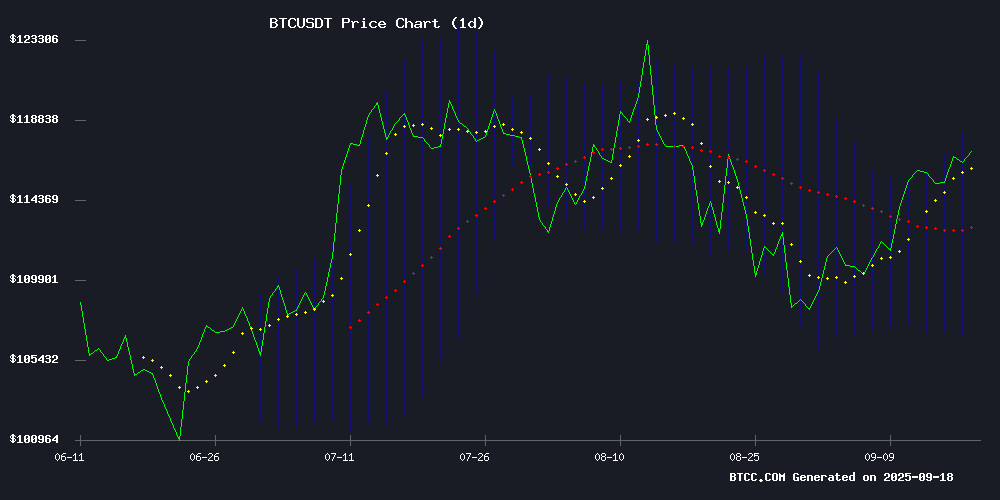

BTC is currently trading at $117,292, firmly above its 20-day moving average of $112,905, indicating sustained bullish momentum. The MACD reading of -2911.22 suggests some near-term consolidation, though the price holding above the middle Bollinger Band at $112,905 demonstrates underlying strength. According to BTCC financial analyst Emma, 'The technical setup supports continued upward movement, with the next major resistance at the upper Bollinger Band of $118,632.'

Market Sentiment: Institutional Adoption and Monetary Policy Drive Optimism

Positive catalysts are emerging from both corporate adoption and monetary policy developments. The extension of BFC's partnership through 2030 signals growing corporate Bitcoin integration, while the Federal Reserve's rate cut has historically benefited risk assets like Bitcoin. BTCC financial analyst Emma notes, 'The combination of institutional adoption and accommodative monetary policy creates a favorable environment for BTC's medium-term appreciation, despite short-term volatility around the $116K level.'

Factors Influencing BTC's Price

AIXA Miner Introduces Cloud Mining with Daily BTC Rewards Up to $20,000

Bitcoin's narrative is evolving beyond price volatility as investors seek stable income streams. AIXA Miner emerges as a solution, offering cloud mining contracts that eliminate the need for physical rigs and high energy costs. The platform provides a free $20 sign-up bonus and contract options starting at $100, democratizing access to Bitcoin mining.

High-tier contracts now promise daily rewards exceeding $20,000, a figure previously reserved for large-scale miners. This development aligns with growing demand for consistent crypto income unaffected by market fluctuations. Cloud mining's appeal lies in its simplicity—users rent computing power rather than manage hardware, making Bitcoin rewards accessible to a broader audience.

US Lawmakers Discuss Bitcoin Reserve and Market Structure with Crypto Executives

Members of the U.S. Congress, including prominent figures such as House Speaker Mike Johnson and Senator Cynthia Lummis, convened with cryptocurrency industry leaders this week to deliberate on proposed legislation for a national Bitcoin reserve and market reforms. The discussions, hosted by the Digital Chamber and its affiliates, centered on the strategic implications of a Bitcoin reserve and the policies needed to support it.

Key attendees included MicroStrategy co-founder Michael Saylor and Coinbase CEO Brian Armstrong. The BITCOIN Act emerged as a focal point, aiming to establish a reserve that could bolster the nation's financial future. The roundtable underscored growing institutional interest in Bitcoin as a strategic asset.

Crypto Market Dips Slightly Following Fed's Expected 25 Bps Rate Cut

The cryptocurrency market experienced a modest decline after the Federal Reserve announced a 25 basis point rate cut on September 17, reducing benchmark rates to 4%-4.25%. Bitcoin briefly touched $114,940 before recovering to $115,698, while the total crypto market cap slipped 1% to $4.1 trillion.

Market analysts attribute the dip to a classic 'sell-the-news' reaction, as traders capitalized on positions built in anticipation of the widely predicted move. The Fed's simultaneous commitment to quantitative tightening—continuing to unwind its balance sheet by selling Treasury securities—created conflicting signals for risk assets.

While the rate cut theoretically improves liquidity conditions, the ongoing balance sheet reduction effectively counteracts this stimulus. This dual approach reflects the central bank's cautious stance amid persistent inflation concerns, leaving crypto markets searching for clearer directional cues.

Analysts Highlight 3 Value Stocks with Over 30% Upside Potential, Including Bitcoin Miner CleanSpark

Value investing strategies are gaining traction as market volatility persists. CleanSpark (CLSK), a sustainable Bitcoin mining firm, emerges as a standout opportunity with a 77.91% projected upside. The company's August operational update revealed robust mining output, while its 11.72x P/E ratio sits 12% below financial sector medians.

Wall Street's bullish stance reflects growing institutional confidence in select crypto-adjacent equities. CleanSpark's energy-efficient mining operations position it favorably as Bitcoin's network difficulty adjusts post-halving. The $20.38 average price target suggests analysts anticipate significant re-rating as earnings visibility improves.

Bitcoin Price Struggles at $116K: Can it Break Free Soon?

Bitcoin remains ensnared at the $116,000 resistance level, with Bitfinex analysts cautioning that a decisive breakout is needed to reignite upward momentum. The cryptocurrency has faltered since touching its all-time high of $124,100 in mid-August, now hovering near the entry points of buyers who accumulated between $108,000 and $116,000.

Market attention pivots to the Federal Reserve's impending rate decision, a potential catalyst for volatility. Fundstrat's Tom Lee posits that rate cuts could propel Bitcoin higher, though the path remains uncertain. The $116,000 threshold now serves as both technical barrier and psychological battleground for traders.

Powell’s Policy Remarks Stir Crypto Markets Amid Economic Uncertainty

Federal Reserve Chair Jerome Powell’s latest comments have injected volatility into cryptocurrency markets, with Bitcoin holding at $115,600 as traders anticipate potential rate cuts. While Powell struck a cautiously optimistic tone on inflation moderation, his emphasis on employment weakness and lack of clear forward guidance left markets grappling with uncertainty.

The Fed’s policy dilemma was laid bare in its statement: 'Latest indicators show economic growth slowed in the first half of the year. Inflation continues to hover high while employment risks grow.' This delicate balancing act between price stability and labor market concerns has direct implications for risk assets like BTC, which typically benefit from looser monetary policy.

Market participants appear to be pricing in a dovish pivot, with Powell noting reduced inflation risks compared to April. Yet the absence of concrete timelines for rate reductions maintains pressure on digital assets. As one trader noted, 'The Fed’s indecision is the decision' - creating a holding pattern for major cryptocurrencies awaiting clearer signals.

Bitcoin ETFs Post Strongest Weekly Inflows Since July Amid Market Rally

Bitcoin exchange-traded products recorded their most substantial weekly inflows since July, with 20,685 BTC added to U.S. spot ETFs. Holdings surged to a record 1.32 million BTC, driven largely by institutional demand ahead of the Federal Open Market Committee meeting.

Fidelity's FBTC product dominated inflows, capturing 36% of the total—an 18-month high. The U.S. market accounted for 97% of global Bitcoin ETF inflows, underscoring its pivotal role in shaping cryptocurrency market dynamics.

André Dragosch of Bitwise Investments observed that Bitcoin's price action now shows unprecedented correlation with ETF flows. Over the past month, investor accumulation outpaced new Bitcoin supply by nearly ninefold, with 22,853 BTC absorbed by markets.

Federal Reserve Cuts Interest Rate After Economic Slowdown

The Federal Reserve has lowered its benchmark interest rate by 25 basis points to 4%-4.25%, marking the first cut in ten months. This decision reflects growing concerns over a slowing U.S. economy, with recent data showing moderated growth and a decelerating job market. August's employment report added only 22,000 jobs, pushing unemployment to 4.3%—the highest since 2021.

Financial markets reacted swiftly. Bitcoin rose 1%, demonstrating cryptocurrencies' sensitivity to monetary policy shifts. Major U.S. stock indexes maintained their upward trajectory, having priced in the anticipated rate cut. The Fed's cautious approach underscores its balancing act between stimulating growth and maintaining stability.

Fed Cuts Rates for First Time Since 2022, Bitcoin Rises 1%

The Federal Reserve lowered its benchmark interest rate by 25 basis points to 4%-4.25%, marking the first cut since December 2022. Policymakers cited moderated economic growth and a slowing labor market, with August's jobs report showing just 22,000 positions added and unemployment climbing to 4.3%.

Bitcoin gained approximately 1% immediately following the decision, while U.S. equity indexes extended their record-breaking rallies. The move comes amid political pressure from President Trump, who has repeatedly criticized the Fed's reluctance to act despite softening inflation indicators.

Market participants now await Chairman Jerome Powell's press conference for clues about future policy direction. The central bank's pivot to easing after ten months of inaction signals growing concerns about economic momentum, creating favorable conditions for risk assets including cryptocurrencies.

The Fed Excites Global Markets with Anticipated Rate Decision

Global markets reacted to the Federal Reserve's widely anticipated 25 basis point rate cut, with Bitcoin hovering near $116,000 ahead of the announcement. The move marks a pivotal shift in monetary policy, following Chair Powell's earlier signals at Jackson Hole. Fed projections now indicate a median interest rate of 3.625%, with additional cuts expected through 2027.

Market attention focused intensely on the dot plot revelations, showing nine of nineteen Fed officials foresee two more cuts in 2025. The unemployment rate is projected to reach 4.5% by end-2025. While Governor Miran dissented on the half-point cut preference, the decision underscores growing confidence in inflation control despite softening employment data.

BTC Inc. and Strategy Extend BFC Partnership to 2030, Bolstering Corporate Bitcoin Adoption

BTC Inc. and Strategy Inc. have renewed their strategic partnership for the Bitcoin for Corporations (BFC) initiative, extending the program through 2030. The collaboration now includes 38 companies holding 69% of all corporate-owned Bitcoin, underscoring BFC's dominance as the central hub for institutional adoption.

The initiative spans North and South America, Europe, and Asia/Oceania, offering a blueprint for corporate Bitcoin integration. Executive networking, investor relations support, and educational resources remain core to the program, equipping leaders with tools to navigate the digital asset ecosystem.

"Securing this five-year extension reinforces our commitment to accelerating corporate Bitcoin adoption," said BFC representatives. The renewal solidifies BFC's position as the premier platform for corporate treasuries and institutional allocators.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and fundamental developments, BTC shows strong potential for long-term appreciation. The convergence of institutional adoption, favorable monetary policy, and increasing mainstream acceptance supports a bullish outlook across all time horizons.

| Year | Price Prediction | Key Drivers |

|---|---|---|

| 2025 | $150,000 - $180,000 | ETF inflows, halving effects |

| 2030 | $300,000 - $500,000 | Institutional adoption, regulatory clarity |

| 2035 | $800,000 - $1,200,000 | Global reserve asset status |

| 2040 | $1,500,000 - $2,500,000 | Mass adoption, scarcity premium |

BTCC financial analyst Emma emphasizes that 'while short-term volatility is expected, the long-term trajectory remains strongly positive due to Bitcoin's fixed supply and growing demand dynamics.'